Thinking about how money moves from one person to another can be pretty interesting, and for a lot of folks, writing a check still comes up. It's a way of sending funds that has been around for a while, and even with all the new ways to pay, it still holds a place. You might wonder, is that still a thing people do? Well, it absolutely is, for many different reasons, and knowing how to do it right can really help you out.

There are situations where a paper check is just what you need, perhaps for a large purchase, paying rent, or even when you are just giving a gift. Knowing the ins and outs of getting a check ready, or what some people call "check casting," helps make sure your money goes where it is supposed to, without any problems. It's a process that needs a little bit of care, and, you know, it is about making sure everything lines up.

This article will walk you through the important parts of preparing a check, from understanding what it really means to how you can make sure it's valid and safe. We will look at why these paper payment methods are still around and how you can manage them with confidence. It is, after all, about making sure your financial doings are as smooth as possible.

Table of Contents

- What is Check Casting?

- Why Checks Still Matter Today

- The Process of Casting a Check

- Ensuring Your Check's Validity

- Common Questions About Check Casting

- Looking Ahead: The Future of Payments

What is Check Casting?

When we talk about "check casting," we are basically talking about the act of getting a financial check ready and sending it off. It means preparing that written paper that tells your bank to give a certain amount of money to someone else. This piece of paper, you know, has a date, your signature, and it directs your bank to pay a specific sum to a person or a group, who we call the payee. It is a very formal way of making a payment, in a way, and it requires a bit of attention to detail.

This process is more than just scribbling on a piece of paper; it involves making sure all the necessary bits are there for the check to be accepted and processed correctly. It is about creating a valid instruction for your bank. The goal is for the money to get to the right hands without any fuss, and that, you know, makes a lot of sense.

The term "casting" here suggests the careful preparation and issuance of something important, much like casting a vote or casting a play. It is about putting something out there with a specific purpose. So, when you are "casting a check," you are, in essence, putting a financial instruction into motion. It is a bit like setting things up just right.

Why Checks Still Matter Today

You might think that with all the digital payment options we have now, paper checks would be a thing of the past. But, actually, they are still quite relevant for a lot of people and situations. For instance, many landlords still prefer checks for rent, and some businesses use them for payroll or to pay suppliers. It is, you know, a method that offers a clear paper trail, which can be very helpful for keeping track of your money.

There are times when a digital transfer just will not do, perhaps because the other party does not have the right setup or prefers a traditional method. Checks also offer a sense of security for some, as they are a tangible item that represents the money. It is a physical promise of payment, in a way. You see, even in our fast-moving world, these older methods still have their place, and that is pretty interesting.

For certain large transactions, a check can feel more secure than carrying a lot of cash, or even some digital transfers. It is also a way to pay someone without needing their bank account details, which can be a privacy concern for some. So, they stick around for good reasons, and, you know, they are not going anywhere anytime soon for many people. Knowing how to deal with them is, therefore, still a very useful skill to have.

The Process of Casting a Check

Getting a check ready to send out involves a few important steps, each one making sure the payment is clear and correct. It is about making sure every piece of information is where it needs to be, and that it is easy for the bank to understand. This process helps prevent any mix-ups or delays, which, you know, nobody wants when it comes to money.

Gathering What You Need

Before you even start writing, you will want to have everything you need right there. This includes your checkbook, of course, and a good pen that uses ink that will not smudge easily. You will also need the exact name of the person or company you are paying, and the precise amount of money you want to send. It is, like, pretty basic stuff, but it is important to get it all together first.

Having all this information at hand helps you avoid mistakes as you fill out the check. It is a bit like getting all your ingredients ready before you start cooking; it just makes the whole thing go smoother. You want to be sure of the spelling of the payee's name, for example, and that the numbers are absolutely correct. So, taking a moment to gather these things is a smart move, really.

Also, it is a good idea to have a record of your balance, so you know you have enough money in your account to cover the check. This step is super important to avoid any issues with your bank. You do not want a check to bounce, after all, and that can cause problems for everyone involved. So, a quick check of your funds is always a good idea.

Filling Out the Check Carefully

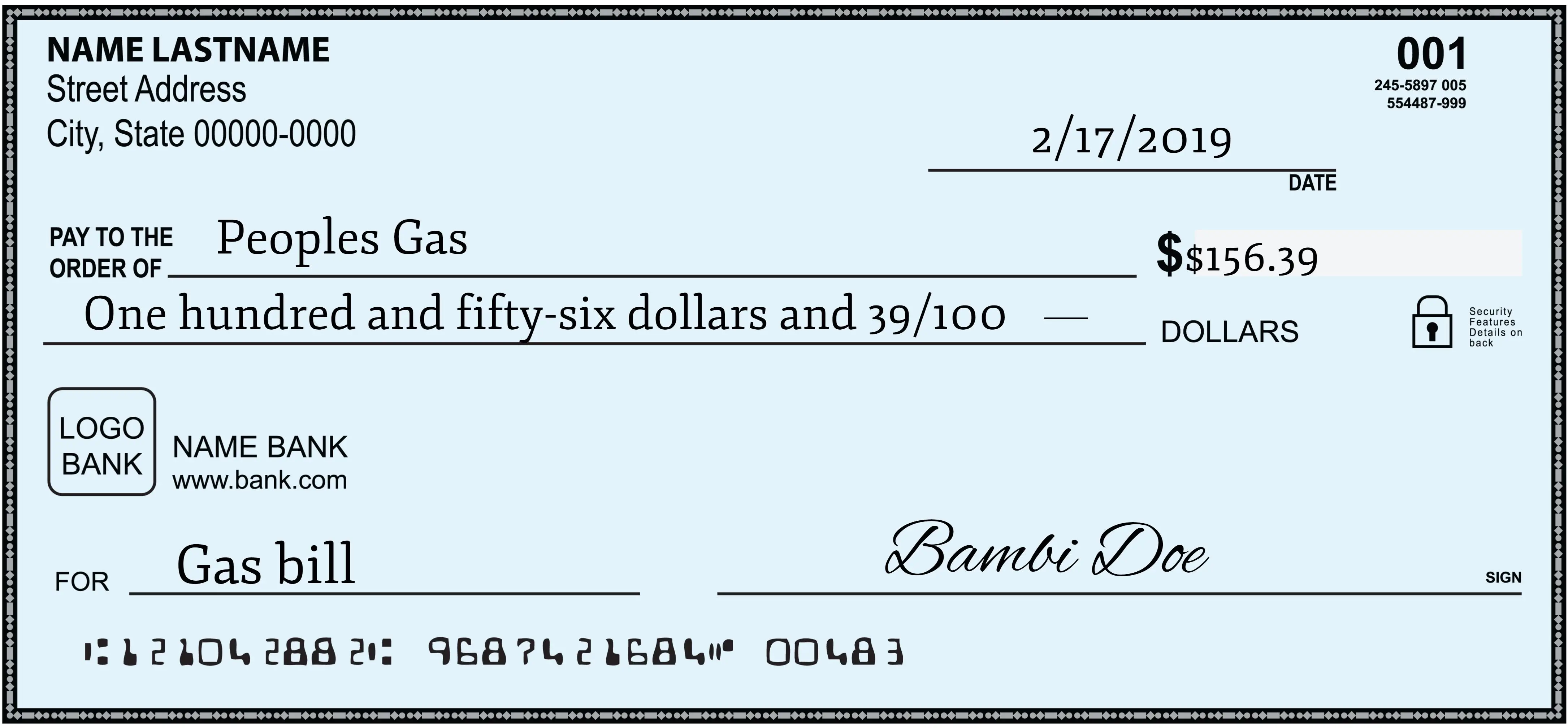

Now, when you are actually writing on the check, you need to be very precise. Start by putting the current date in the top right corner. Then, on the line that says "Pay to the Order of," write the full name of the person or business getting the money. It is really important to be accurate here, as any mistakes could cause problems, you know, with the bank.

Next, write the amount of money in numbers, usually in a box or next to a dollar sign. After that, write the same amount in words on the line below. This is a crucial step because if there is a difference between the numbers and the words, the bank will typically go by the amount written in words. So, making sure these two match up is a big deal, actually.

Finally, you will sign your name on the bottom right line. Your signature is what gives the bank permission to take the money from your account. You can also add a memo line at the bottom left to note what the payment is for, like "November Rent" or "Car Repair." This little note helps you remember what the check was for later, and it is, you know, a good habit to get into for your records.

Making It Valid and Secure

Once you have filled out all the parts, you want to make sure the check is ready to go and that it is safe. This means double-checking everything you have written down. Look over the date, the payee's name, and both the numerical and written amounts. Are they all correct? Is your signature clear? This quick review can save you a lot of trouble later, really.

For added security, some people might write "For Deposit Only" on the back if they are mailing it directly to a business or if they want to ensure it can only be put into an account. This helps prevent someone else from cashing it if it gets lost. It is a little extra step that can offer a lot of peace of mind, you know.

Keeping a record of the check is also a smart move. Many checkbooks have a register where you can write down the check number, the date, the payee, and the amount. This helps you keep track of your spending and makes it easier to balance your account later. It is, basically, about being organized with your money, which is always a good thing.

Ensuring Your Check's Validity

Making sure a check is valid is about more than just filling in the blanks. It involves understanding what makes a check legitimate and how to protect it from problems. This part is about confirming that your payment will be accepted and processed without any hitches. It is, you know, a pretty important aspect of the whole process.

The Role of Checkmark Symbols in Confirmation

While not directly on a physical bank check, the idea of a "checkmark" as a symbol of validity or completion is very much part of our daily lives, and it relates to the broader meaning of "check." When you see a checkmark symbol, it tells you that something is good, or that it is done, or that it is valid. This concept applies, in a way, to how we confirm things in many areas, including finance. For example, when your bank processes a check, they are, in essence, putting a "checkmark" on it, confirming it is valid.

In the digital world, these checkmark symbols are everywhere. They are used to show that something is confirmed or approved. You can find many different kinds of checkmark symbols to use in your text or social media posts, like the ones you might find on a website that lists various text symbols. It is really easy to copy and paste them into your documents or online messages. Just click on the symbol you want, and it is ready to use. This kind of symbol helps to quickly show that something is verified or complete, which, you know, is a useful tool for communication.

For instance, if you are confirming details about a payment online, a digital checkmark might appear to show that your transaction was successful. It is a quick visual cue that everything is in order. These symbols, you know, are a simple way to communicate "yes, this is correct" or "yes, this has been done." They provide that instant confirmation, which is pretty handy in a lot of situations.

To learn more about text symbols and how they can enhance your digital communication, you can explore resources on our site. They are, after all, a quick way to convey meaning.

Important Security Measures

Keeping your checks safe is a big deal. You want to protect them from anyone who might try to use them wrongly. One very simple step is to keep your unused checks in a secure spot, maybe a locked drawer or a safe place at home. Do not just leave them lying around where anyone could pick them up, you know, that is just asking for trouble.

When you are writing a check, try to use a pen with ink that cannot be easily erased or altered. This makes it much harder for someone to change the amount or the payee's name after you have written it. It is a small detail, but it can make a big difference in preventing fraud. So, pick your pen carefully, really.

Also, always keep an eye on your bank statements. Check them regularly to make sure all the transactions match the checks you have written. If you see anything that looks odd or unfamiliar, contact your bank right away. Being alert and proactive can help you catch any problems early on, and that is, you know, super important for your financial well-being.

If you ever need to reorder bank checks, you can often do it online, and it is usually a pretty straightforward process. Many banks offer this service, and you can often get the same low price every time you reorder. This is a convenient way to keep your check supply stocked up without much fuss. You can find more information about secure banking practices on our site, which is, like, a good thing to know.

Common Questions About Check Casting

People often have questions about checks, especially as digital payments become more common. Here are a few common inquiries, you know, that might pop up.

Is check casting still relevant today?

Yes, absolutely. While digital payment methods are very popular, paper checks still serve a vital purpose in many situations. They are often used for large payments, rent, utility bills, or even by businesses for certain transactions. The clear paper trail they provide is still highly valued by many, so they are not going away anytime soon, really.

What are the steps to cast a check properly?

To get a check ready correctly, you first need to fill in the date, then the name of the person or company receiving the money. After that, write the amount in numbers, and then write the same amount in words. Finally, you sign the check. It is important to be precise with each step to make sure the check is valid and goes through without issues, you know, for everyone involved.

How do I ensure a check is valid and secure?

To make sure your check is good and safe, always use a pen with permanent ink. Double-check all the details you have written to make sure they are correct and clear. Keep your unused checks in a safe place. And, importantly, regularly review your bank statements to catch any unusual activity. These steps help protect your money and make sure your payments are processed smoothly, you know, without a hitch.

Looking Ahead: The Future of Payments

While we see more and more digital ways to send money, the paper check still holds its ground. It is a testament to its reliability and the comfort many people find in a tangible payment method. The way we pay for things is always changing, but some methods just stick around because they work so well for certain needs. It is, you know, interesting to see how things evolve.

We might see even more ways to combine the old with the new, like checks that can be deposited by just taking a picture with your phone. This blends the traditional check with modern convenience. So, while the future might bring even more innovation, the basic idea of "checking" something, whether it is a financial transaction or just confirming a detail, will always be important. It is, basically, about making sure things are right.

The core meaning of "check" — to inspect, examine, or look at something carefully — will always be relevant, no matter how we send money. Whether you are preparing a physical check or confirming a digital payment, the act of making sure everything is correct is key. So, understanding these processes helps you manage your money with confidence, and that, you know, is a valuable skill to have in any time.

Detail Author:

- Name : Oscar Hamill

- Username : pkeebler

- Email : oda.rogahn@hotmail.com

- Birthdate : 2003-07-16

- Address : 756 Jason Walks Lake Milesborough, NC 57744-7443

- Phone : 325-503-0320

- Company : Champlin-Shanahan

- Job : Illustrator

- Bio : Ipsa id quas non sed qui. Illum iste minus cum maiores ut beatae numquam reiciendis.

Socials

instagram:

- url : https://instagram.com/alphonso_berge

- username : alphonso_berge

- bio : Facilis rerum commodi dolor sint et. Consectetur omnis ipsum odit. Quis eos eius qui et animi.

- followers : 2529

- following : 688

twitter:

- url : https://twitter.com/bergea

- username : bergea

- bio : Quis pariatur rerum nisi unde est voluptatem. Dolor consectetur cupiditate eaque praesentium ea. Modi exercitationem odit et et. Omnis rerum provident cum et.

- followers : 3812

- following : 1108

linkedin:

- url : https://linkedin.com/in/alphonsoberge

- username : alphonsoberge

- bio : Voluptatem doloribus aut debitis aspernatur.

- followers : 6225

- following : 439

tiktok:

- url : https://tiktok.com/@aberge

- username : aberge

- bio : Odio consequatur ipsam non sed.

- followers : 6135

- following : 1341

facebook:

- url : https://facebook.com/alphonso_xx

- username : alphonso_xx

- bio : Sunt veniam reiciendis corporis culpa atque incidunt et.

- followers : 5368

- following : 1976